Green Appraisers

Once what was invisible and irrelevant to the naked eye can now be documented, quantified, published and benched mark for competitive advantage market resale for your largest investment. Your green communities certified home. Missing from the marketplace for more than decade sustainable homeowners can now find and locate a knowledgeable green appraiser having access to universal green underwriting tools are now able to quantify all the individual specific green appraisal features constructed into your green communities home. In September 2011 The appraisal institute introduced form number 802.03. The green appraisal addendum allows: homeowners, builders, Green appraisers and green brokers to document and individually value upgraded green building energy/water efficient features.

Residential Green and Energy Efficient Addendum (pdf download)

Residential Green Appraisal Addendum

Residential Green Addendum is a specific addendum to be used in conjunction with popular Fannie Mae/Freddie mac Uniform Mortgage Data Program (UMDP) The UMDP improves quality, promotes transparency, consistency and accuracy throughout the mortgage lifecycle.

Both GSE Fannie Mae and Freddie Mac underwriting guidelines require all lenders to choose knowledgeable appraisers who have the essential knowledge to perform an appraisal for a specific geographic region or property type. The green addendum is specifically designed for knowledgeable green appraisers who are familiar with and completed specialized education for valuing residential and commercial green buildings, residential green valuation tools, residential and commercial solar photo voltaic valuations

The updated residential green addendum now has a full field by field reference guide for each of the 140 different fields in the green addendum. This will facilitate the comprehensive understanding of the green terminology and reduce the interpretation variances for green appraisers.

It is forecasted that green appraisers will implement uniform green appraisal coding/ aka green tagging of all the individual green features to document the smart supply line beginning from green appraisal to incorporate into the green mortgage, to analyze and measure the reduced risk green default rate. In 2018 Freddie Mac introduced green choice mortgage and has developed specific green underwriting standards to differentiate between lower rate green mortgages and conventional mortgages.

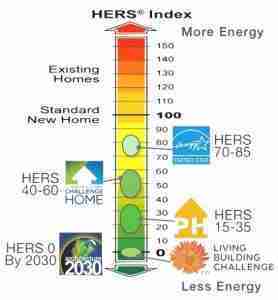

Currently each individual energy/water efficient feature can be independently analyzed and third party documented. Such features can include but not limited to: specific green certification. HERS score, HES, solar panels, tank less water heater, additional insulation, triple pane windows, weatherization, geothermal heat/cooling, walk score and radon mediation.

Where can I find a green appraisal?

With a fragmented appraisal market, it is important to locate a qualified green appraiser that has the prior course completion education, and knowledgeable on going green metrics to properly appraise residential and commercial green buildings, including residential and commercial valuation of solar systems. Each appraisers knowledge and experience is unique. The Uniform Standards of Professional Appraisal Practice (USPAP) requires all appraisers to be competent to perform their current assignment. Acquiring the necessary competency to perform the scope of work. This includes through knowledge of all green building techniques. Otherwise withdrawn from the assignment. An appraiser signing the appraiser certification without the competency requirement is liable if the appraisal is found to be less than credible.

The homeowner should ask questions to the appraiser to verify they are qualified or be replaced by a registered green appraiser. This is an important distinction that is commonly overlooked which could lead to a valuation dispute and thereby effect the green mortgage application. A properly documented green appraisal will effect the amount the homeowner can borrower. As green building now has its own dedicated specialized green mortgage financing offering financial benefits and incentives. The green mortgage underwriting “stretch ratio” allows a borrower to borrow a larger mortgage amount using the same amount of monthly income. Thereby the compatible green mortgage financially compensates the borrower for purchasing a 3-5% higher cost green home. A complete forgotten afterthought for the last 20 years. No a green home does not cost more to own.

This scenario of events has confused the public, to become misinformed, that certified green homes cost more to build and deliver the same value as conventional homes. Public perception is that green building costs can range for 1% more all the way up to 30% higher than conventional construction. In reality green building costs average from 1% to 5% more, and deliver far superior results. These additional costs are added to the resale value of the home. Positioning the green home more competitively in the local marketplace with lower monthly operating costs and a higher appraisal amount. Demanded by todays buyers.

This false perception leads to public confusion as what constitutes certified green building and leads to false green washing claims. There are numerous green building applications, The most common green building science principles incorporated into green appraisals focus on site location, water efficiency, energy sources and efficiency, green building materials used, operations and maintenance costs and Indoor air quality (IAQ) which is becoming more predominant, with individuals spending 90% of their time indoors. In the near future Imbedded Carbon will be calculated for each residential home.

This false perception leads to public confusion as what constitutes certified green building and leads to false green washing claims. There are numerous green building applications, The most common green building science principles incorporated into green appraisals focus on site location, water efficiency, energy sources and efficiency, green building materials used, operations and maintenance costs and Indoor air quality (IAQ) which is becoming more predominant, with individuals spending 90% of their time indoors. In the near future Imbedded Carbon will be calculated for each residential home.

With 60% of NAR Realtors unable to answer basic homeowner questions about energy efficiency. The homeowner can be a valuable assistant to the green appraiser, providing specific relevant third party documentation in preparation for the green appraisal. Such documentation should include: energy star, or other national recognized green certifications, numerical HERS rating score, HES, all types of green renovations/ specific energy upgrades, documentation such as: Added insulation R-value, geothermal information, solar panels, age/type of asphalt singles, Garage door rating, windows UV rating and all types of water conservation fixtures/devices which are now becoming a relevant addition to the green appraisal. All of these verifying documents need to be assembled, by the greenappraiser.com and included in the green mortgage underwriting documentation package. Including photo gallery of all EE/water upgrades.

Department of Energy (DOE), Berkley lab and Sun shot performed a multi state study of homes with photo voltaic solar panels installed. The added value of solar panels is becoming increasingly important with home buyers now paying a green premium for these homes across the nation. The added green appraisal value is $4.00 watt or $15,000 for an average size system of 3.6KW solar system. The market depreciates the value of the PV system in the first 10 years exceeding the rate of straight line depreciation over the use full life of the system. Net cost estimates may now be the best analysis for market premiums. Which are based on government and utility incentives. In the fourth quarter of 2016 the solar panel market has shifted from third party leasing towards customer ownership.

Leasing has fallen to forty seven percent of all new installed residential solar panels. Sunrun which dominates the residential solar panel market with a 17% market share. Saw a shift in consumer ownership to 28% of all solar panel instillation’s. Third party solar panel leasing provided the initial temporary financing mechanism to offer solar panel instillation’s. Green appraisers can assemble all of this green underwriting documentation which can be used in conjunction with the green appraisal residential addendum form. Additional documentation can include the PV values spreadsheet will provide consistent green appraisals for green communities homes that have photo voltaic instillation. (solar panels) and wind turbines! Documenting these green features can now monetized and add additional value to your green appraisal!

Green appraisals incorporate and document: All green certifications, EE/water efficiency improvements, upgraded green renovations, insulation, heating/cooling, Low E windows U factor, etc. and use the HERS scale as an industry accepted numerical score for the energy efficiency of certified green homes. The HERS scale ranges from zero to 100. The lower the number the more energy efficient the home is. At the extreme end of the scale is zero which is net zero real estate. Meaning that the home consumes as much energy as it produces. This is the 2050 goal of the Biden administration. Although there is a database of more than 2 million homes nationwide that have been HERS certified by Resnet. Consumers sometimes find the HERS scale intimating? Therefore a more consumer friendly approach has been recently implemented. Utilityscore is a database of 80 million homes nationwide that provides a monthly cost of utilities. Similar to miles per gallon for cars.

Traditional appraisers current average age is 55 years old and are falling behind on modern standards. Are not familiar with green building or net zero real estate evolving green features and have previously failed to properly recognize and document these energy savings features in the green addendum. Completely overlooking the increased monetary value of energy and water efficient features which lowers the green properties annual operating costs. This has resulted in a lower appraisal valuation of green properties. Atlanta, and Seattle, have the highest water rates in the country. Forty percent of Philadelphia households have had their water shut off since 2014 for non payment. Detroit has shut off water to 50k households. Water is now a scarce and valuable commodity. Water efficiency is now considered important by over 70% of green home owners.

As water conservation is now becoming a developmental recognized resource. Resnet has developed a companion water rater tool as a strategic alliance to the nationally recognized HERS score. The HERs H20 score will be an asset based rating. Which will predict the water use of a home/building by the number of bedrooms. The H20 index measures water conservation using faucets, shower heads, toilets, washing machines, outside irrigation and potential leaks. The homes/buildings water score will be calculated by comparing a new homes water consumption to a 2006 reference home. The water scale parameters will be from zero to 100. With 100 being the most desirable. In 2022 over 2200 homes have been rated. The average HersH20 score was 61. Meaning the home was 39% more water efficient than the 2006 constructed home. This has save 129 million gallons of water.

HERS H20 will be updated, and individually sanctioned by: International code council, ICC, ANSI and the NAHB. HERS H20 will be know as water rating index (WRI) and can be used as a stand alone water efficiency rating. WRI has expanded its green metrics and can now account for: grey and black water reuse, rainwater capture and reuse. Green appraisers will need to be familiar with the upgraded water rating index(WRI).

An independent water rater will calculate the water conservation and prepare a numeric score which can be additional documentation added to the green appraisal addendum. A water rating score is inclusive of indoor and outdoor water use. The water rating ranges from 1 to 100 the higher the score represents a more water efficient home. Documenting to the home buyer a new metric that can compare a homes water consumption to another homes water consumption. The Resnet HersH20 can be used for new and existing homes.

This new water conservation numeric metric will become a dominate green metric in the green mortgage underwriting process. As water and energy conservation effects 30% of the monthly operating cost of a home/building. Reducing the monthly expenses by 30% dramatically effects the green net operating income of homes and commercial buildings. As Fannie Mae’s green mortgage underwriting requirements evolve and gain traction in the green securities aftermarket. Fannie Mae and Freddie Mac has increased the water savings in 2019 up to 30% water savings requirement.

As solar photo voltaic systems are now the most popular green feature in green certified homes. Green appraisers have three different green appraisal methods to document the added value of solar panels. The first green appraisal method is using paired sales. Finding a comparable photo voltaic system on a similar property. The second method is the cost approach. Replacement cost of the entire solar system minus depreciation costs. The third method is estimating the value of the energy savings from the solar system. This can be accomplished by using the PV values excel spreadsheet for green appraisers nationwide to enter the zip code of the individual green communities home, As energy prices continue to rise, installing solar panels is the number one green upgraded option for conventional “brown” homes.

Solar panels can be used for: heating your hot water, the second most expensive use of energy. Installing a solar power charging station for your EV vehicle. This integrated option is becoming more popular with Ev tax incentives as the adoption of EV vehicles increases.

Installing a solar thermal heating system, using sunlight to heat water can be 70% more energy efficient. Solar panels can provide energy back for sustainable homeowners as electrical black outs become more common due to electrical grid overload/failures.

In 2022 president Biden signed the 394 billion dollar inflation reduction act, Federal and state tax credits/incentives are available to homeowners for Solar/energy efficient green upgrades. Which can be combined with Greenmortgages.com offering a lower interest rate and a higher L/v to offset this cost.

As the cost per watt continues to fall, The efficiency of solar panels continue to rise! Today’s silicon based solar panel efficiency is between 17 to 19 percent. Sunrun is currently developing and manufacturing a solar panel at over 22% efficiency. Purdue university and NREL have developed a new material called perovskites which is thinner than silicon cells, more flexible, inexpensive can improve the solar panel efficiency rate up to 30%!

The PV value solar appraisal was designed by the Sandra National Laboratory to document and standardized green appraisals nationwide. This nascent green underwriting tool can be used by knowledgeable green appraisers, green brokers, green underwriters, green mortgages and green securities, to provide accurate current appraisal value for bench marking PV solar systems and wind turbines. Additionally a sustainable home-owner can now estimate the remaining present value, quantify the PV system and is able to place a monetary value of an energy efficient feature (solar panels, wind turbines) to a perspective sustainable home-owner purchaser.

Currently Sunrun can now sell energy to homeowners in 22 states at a rate lower than the local utility company. As photo voltaic technology rapidly moves forward, the current common practice of simply installing an unsightly solar panel on top of a conventional “dumb” roof will become obsolete! Starting in 2020 all California homes will be required to have solar energy installed! This could include changing traditional roof architecture and the homes location to face west or south on the residential lot for solar efficiency. In 2023 Sunrun started transiting from a solar power generation company to an energy storage first company.

Additional options for 2021 can now include Tesla’s improved “version 3” aesthetic solar shingles that look like traditional shingles, replace the conventional “dumb roof” include mini glass quartz solar panel cells in each of the 45 inch by 15 inch individual solar shingle squares. Version 3 represents a 5 year improvement cycle, lowering instillation time, lower costs, and fewer movable parts. Solar shingles remove the unsightly raised solar panels and present a more uniform aesthetic looking roof. Tesla solar shingles are available in 16 states, and offer a 25 year warranty. Tesla has recently partnered with Mississippi power to install solar shingles on a 200 home smart neighborhood where research and analysis can be performed.

A Tesla roof is more expensive than a solar panel roof. Costing an average of $150,000 BEFORE TAX INCENTIVES. Tax incentives average $46,000. Tesla roofs are a combination of corrosion weather resistant steel tiles and solar glass tiles. Approximately 3 or 4 solar tiles for every seven steel tiles. A Tesla Powerwall battery will be required with a minimum cost of 11,500. The energy capacity of a single Powerwall is 13.5 KW. Tesla solar inverter is included.

US residential solar panel instillation is changing to include a battery storage system. Fifty percent of residential storage batteries have been Tesla Powerwall’s in 2023. Sunrun and Tesla have installed 55% of all residential battery energy storage systems in 2023. Tesla market share is 30% and Sunrun’s market share is 20% New technology includes a portable lithium storage battery that now weighs less than 10 pounds! Lithium storage batteries can now charge your hybrid vehicle. EV Hybrid charging is now compatible with home energy storage systems.

As green appraiser’s slowly incorporate universal green underwriting tools in specialized green appraisals the green data will be published in the various 800+ MLS (multiple listing service) nationwide to provide comparable green appraisal comps, bench marked to conventional brown residential values. The green addendum has now been upgraded to digital form and can be attached to any MLS listing documenting all types of green features for future greenbroker marketing.

The green addendum can now be read electronically by end user operating systems. Including green mortgage underwriting lenders to analyze future debt collateral risk. While this may seem like an isolated innocuous event. This is the nascent beginning of advanced green underwriting incorporation of green ESG metrics. Currently 30% of mortgage underwriting utilizes artificial intelligence. This is going to rapidly expand under the incoming Biden administration, climate risk will soon be incorporated into the GSE underwriting of the common 30 year mortgage.(Esgmortgage.com).

In 2022 30% of Americans cited climate change as a reason to move! One in ten homes was impacted by climate change in 2022. With the total damage costing over 56 billion dollars! Future homebuyers are moving away from wildfires prone areas, sea level rise, coastline erosion, hurricanes are all reasons homeowners are now moving as residential insurance rates are rapidly rising! Increasing the unseen costs of home ownership.

As the green comparable (comps) are accumulated, there is now nascent documented bench marking evidence that a green communities home has a higher appraisal amount, depending on the homes location. Seattle and California now has a 9% green appraisal premium. Portland, Oregon has a 8% increased value, Austin, Texas a 6% premium, and Atlanta, Georgia has a 5.6% increased value. Additionally green homes sell as much as 4 times faster. This is significant financial comparable data as acknowledged unsophisticated conventional real estate brokers, appraisers, home builders and news media outlets have previously failed to accurately represent, publish and correctly value your green communities home nationwide. These inaccurate results add to a false public perception of certified green building.

What was previously undocumented, considered confusing and nebulous is now solidified, third party documented and bench marked. This documented increased green premium value is significant, as the increased green appraisal value can completely cover the selling/listing commission for your green communities home! A $400,000 dollar green communities home with a 9% increased green value is $36,000 dollars! This green premium now exceeds the entire greenbroker sales commission! So a knowledgeable green appraiser/green broker tandem pays you financial dividends for their specialized green knowledge directly benefiting your family and your personal pocketbook! Conversely, a traditional conventional appraiser has no knowledge of green building and therefore fails to properly appraise and document your largest investment. Specifically devaluating green building monthly cost savings.

With aggregated green data, green features and information collection comes power and knowledge! Now when this green appraisal package is properly assembled your family is now prepared to receive the added financial benefits of the green mortgage. It has been believed by the public at large for longer than a decade that green building costs more than conventional building. While this statement may sometimes be true. Green building could cost from (1-3%) more than conventional construction. A lower interest rate green mortgage, offsets these higher green building costs/improvements. A complete failure to communicate for over a decade, by the US media and all new homebuilders.

However, this nominal additional up front building cost is retained and added to the resale asset value of green communities home. Then we consider that green certified homes spend less time on the resale market, have improved indoor thermal comfort, and consume 30% less energy and water. Buyers now prefer and are seeking out these energy efficient homes with their intrinsic lower operating costs, water conservation savings, healthier lifestyle and now we can factor in nebulous climate change benefits which shape financial polices and an incoming president Biden who will make climate change a national priority.(Biden2050).

With the green appraisal legitimately documenting all types of sustainability features and the resulting performance with lower annual operating costs. Financial incentives added by the green mortgage underwriting. A thirty two percent lower default rate on the green securities. The economic benefit of all types of green building can now be measured in an apples to apples transparent way.

The World bank has recently stated that green buildings are the easiest and most cost efficient way to reduce climate change effects! Reduced annual operating costs effect the green appraisal market value and market capitalization of residential and commercial properties. With lower operating costs the commercial property has a higher market value. After the eight year financial debacle from the George W. Bush administration corporations were unable to raise their prices due to market pressure. The only option left was for corporations to cut operating costs, overhead, layoffs, marketing, and outsourcing etc. Certified green building is now becoming a market competitive differentiator, required by sustainable tenants, documented improved employee productivity, improved occupancy rates using green leases, rental premiums, higher property market capitalization, lower annual operating costs, resulting in a higher resale value.

WHAT IS A BROWN APPRAISAL?

The life cycle of a commercial building or residential home can be a 100 years or more, energy/water savings in all types of real estate are cost efficient. The savings can be documented and accumulated over a long life cycle which accretes enormous cumulative savings which effects the appraisal value, occupancy rate, and financing mechanism. As the market is currently documenting, and the green premium is realized. All types of conventional brown construction will become less desirable, be subject to increasing government regulations, will fall behind in the marketplace competing for occupancy, and financing. These conventional properties (residential and commercial) will be offered at a significant market discount for their lack of sustainability and necessary capitol upgrades to become competitive. The coined term “brown discount” will enter the market place and be used to describe the depreciating value due to its inefficiency and increased regulatory requirements.

It is projected in 2024 after GOP litigation the SEC will have mandatory Co2 emissions disclosure requirements for public companies. Mandatory requirements to disclosure Scope 1,and 2 emissions. On January 1. 2024 California SB253 and SB261 go into effect. Requiring mandatory reporting of Climate emissions. Including scope 1, 2, and 3 emissions. This will effect real estate environmental impact of construction, building material, and daily operations.

Some of these new commercial green buildings are now constructed to net zero real estate status. Consuming as much energy and recycled water as they produce. Using connected internal sensors to monitor all types of energy systems (HVAC, lighting, water) on an hour by hour basis. This allows for real time monitoring to a computer database. When their is a malfunction it shows up immediately and can be repaired quickly reducing energy waste. Additional features now include energy storage systems. This allows storage of excess energy produced during the day to be used in less peak hours. As corporations are now moving along the triz scale to embrace sustainability green building has now moved towards the forefront on a global scale.

Sustainable brokers are commercial property specialists in green knowledge, certified green building, certified wellness real estate, green leasing, and fulfilling corporations sustainability objectives/goals. Well certified buildings are now scientifically documented showing a minimum 60% improved employee productivity for indoor knowledge based employees. Building on the initial success of the Residential green addendum. On February 11, 2015 the Appraisal Institute (AI) release companion form 821 the Commercial Green Energy Efficient Addendum. Designed specifically for Commercial real estate evaluations. Focusing on energy efficient and water conservation features which can account for up to 35% of the annual operating expenses of commercial properties. These individual features can now be itemized and documented in an expanded section of the commercial green addendum. The resulting green NOI net operating income effects the commercial properties capitalization rate which determines the green appraisal value of the property. Preliminary data now documents certified commercial green building can be 13% higher than competing conventional brown buildings

SUSTAINABLE GREEN APPRAISERS DOCUMENT BUILDING PERFORMANCE STANDARDS

With the second Trump reelection and dissolvement of Federal climate change national regulations and nascent emerging ESG regulation guidelines. Climate change disclosure, regulation, adoption, and implementation has now moved to the individual state level. As of January 2025 over 13 separate cities have Building performance standards (BPS). With more than 30 additional cities passing state BPS regulations by 2026. As of 2024 the current BPS regulations cover (25%) one quarter OF ALL BUILDINGS IN THE UNITED STATES. Currently 47 states and local governments have enacted energy benchmarking and transparency laws for commercial buildings.

As these older existing conventional “brown” commercial buildings emit more Co2 emissions, adversely public health, consume more energy, and impede individual states from achieving their 2030 climate goal commitments less than 5 years away. BPS standards establish and regulate minimum state requirements for commercial building energy consumption regulating greenhouse gas emissions. BPS is a local tool developed due to the Anti-Esg national climate regulations , Building codes are enforced on the local level. As we have all witnessed the 20 year national backlash from the NAHB opposing energy efficient upgrades. Adversely effecting homebuyers and their increasing monthly energy bills.

New York, Denver, Washington state, Washington DC , Seattle, Boston, Cambridge, St. Louis, all have BPS regulations and corresponding escalating fines for non compliance. As local BPS regulates, documents, benchmarks the commercial buildings regulatory compliance, documenting the increased value of the green appraisal certified commercial building. A certified green commercial building is in local regulatory compliance increasing its green appraisal value. Conversely older conventional “brown” buildings are not in local compliance, require green contractor upgrades, emit more Co2 emissions, have a higher annual energy consumption adversely effecting the green appraiser capitalization rate. These ” brown” buildings will be harder to finance, rejected from green lenders, ESG compliance companies and risk becoming stranded assets.

Green Appraiser Commercial Green Addendum

Commercial Green and Energy Efficient Addendum (pdf download)

It’s important to remember that green building is an evolving industry in constant changing and market flux. The industry’s tools are developed in hindsight not foresight. All green underwriting tools require accepted accredited standards and take decades to come to realization and market acceptance. There is specific areas of tertiary evidence which will eventually lead to formalized accepted standardized documentation in commercial green appraisal analysis that will effect the green appraisal monetary value of commercial buildings in the future.

INTRODUCING DUPA 2.0

As green building expands world wide more sophisticated sustainable appraisal techniques have now entered the market. Launched on February 2024 in the Netherlands at AMBO bank to be used industry wide. With input from Real estate agents, appraisal firms, software providers, banks, and accountants Dupa 2.0 first edition focus on climate risks and 80 different sustainability criteria, which includes the physical structure, its occupant users, and the buildings physical surroundings. This allows green appraisers/EU valuers to incorporate ESG factors, climate risks, and the physical structure for corporate and commercial real estate appraisals. Designed to be forward looking as the valuation gap between sustainable “green” and non sustainable “brown” commercial buildings widens in the worldwide marketplace.

DuPa 2.0 is no longer simply about the physical building, The commercial sustainable appraisal is expanded including the buildings users and it’s physical surroundings. Using three separate categories. Energy performance, object data and climate risks. Energy performance includes: The current actual energy consumption, Energy rating, insulation, and sustainable upgrades. Object data includes; square footage, year of construction, construction quality materials and ecology. Climate risks include: land substance (Ie: near a river), rainfall, floods, and extreme heat. All of these factors effect the physical aspects of commercial buildings. Previously not even identified, or documented in the commercial appraisal.

Future commercial appraisals may include: Indoor air quality, (IAQ) A recent Seattle study indicated a 40% drop in employee absenteeism. A 10% increase in net revenue from employee productivity, This nascent research has now moved the needle and Indoor air quality is now ranked the second most important green feature, right behind energy efficient/water efficient features.

With property owners, investors, and real estate investment trusts incorporating ESG metrics (REITESG) expectations and purchasing requirements are changing due to increased risk awareness of climate change. Future real estate transactions will require a sensitivity analysis concerning future rising sea levels, redrawn FEMA flood plain zones and wildfire designated hazard zones. Federal FEMA flood maps are drawn on past flood data, not future flood data. As the TCFD oversees financial reporting requirements, climate risk disclosure will become mandatory, Artificial intelligence mortgage underwriting will incorporate future elevating sea level rise risk. This will effect the the cost and availability of 30 year mortgages.

WHAT IS FEMA 2.0?

On October 1, 2021 approximately 5 million policyholders nationwide will see new FEMA regulations being phased in nationwide. FEMA has incorporated new tools to address disparity incorporating more flood risk variables. Climate risk factors like: multiple flood types, flood frequency, distance to the water line, and property characteristics will now determine a structures flood insurance premium. Federal law mandates a maximum of 18% annual increase in flood insurance. Risk rating will be performed by each state. On each green appraisal required by the GSE, there is a box, please check if the structure is located in a flood plain. Therefore as of October 2021, ESG underwriting is now being included in mortgages. This is the first preliminary step separating conventional “brown” structures from “green” structures. The result will be the preliminary bifurcation of the US housing market. With conventional “brown” homes requiring, more government regulations, a retrofit, lower appraisal value, and higher financing costs in the marketplace.

Green appraisers with their dedicated green expertise will perform climate change risk assessments concerning a properties building resilience. Currently all certified green building programs do not evaluate or document a properties climate zone or green neighborhood infrastructure attributes. As climate change starts to adversely effect property and subversively erode real estate values. In 2022 the SEC will require climate stress tests for banks. Which in turn will effect the lenders “brown” property portfolio and mandated CO2 emissions disclosure. Existing “brown” properties will cost more to finance and be allocated fewer finance dollars as these “brown” properties emit more Co2 gas, All lenders will be mandated to limit their greenhouse gas loan portfolio emissions by the Federal Government.

Fannie Mae has recently expanded its green underwriting updating the energymortgage to provide resiliency improvement financing and environmental disaster repairs. Certified Fortified homes construction is specifically designed for severe weather conditions and are compatible with certified green building.

Government guaranteed green mortgages aka energy efficient mortgages(EEM) will eventually expand their green underwriting requirements to include a structured sensitivity analysis requirement as insurance companies are now advocating and implementing revolutionary computer models for property insurance premiums due to accelerating climate risks. As Zillow and government mortgage underwriting requirements evolve to eliminate high risk property abandonment. The green appraiser expertise will be demanded and become a market differentiatior as climate change becomes incorporated in to the ESG underwriting securities portfolio.

Starting in 2022 FHA will allow desktop appraisals to become permanent. Therefore Fannie and Freddie will allow remote appraisals using tax records and public records for purchase properties. These “remote appraisals” will not have a physical appraiser on site to actually analyzed, review, and document the home being appraised. Therefore certified green appraisers will become even more coveted with their green expertise and market differentiation.

Green appraisers will coordinated with green brokers documenting peripheral relevant climate risks incorporated into their green appraisal. Which now include: Climate sensitivity Zone perils, Extreme heat events, Wildfire zone risks, Sea level rise flooding and contamination including septic tank failure. These risks will eventually be incorporated into green mortgage underwriting. This will become a requirement from ESG bond underwriters in the near future!

Research indicates Living walls effect on employee productivity. Individual tenant operating expenses, sub metering. Cloud data, energy dashboards, and wireless sensors. Healthy building materials disclosure and declarations. Energy storage systems. Many commercial buildings have incorporated LED smart lighting. As electric vehicles slowly move towards mass adoption. EV charging stations have currently become a legitimate commercial differentiatior. Green appraisers will soon be documenting nascent evolving green features such as: Coordinating energy consumption demand load for commercial buildings constructed with. Led lighting, smart HVAC, geothermal, solar panels, exterior rows of parking lot EV charging stations all connected by the internet of things (IOT).

Over the next decade all of these items may eventually be recognized for their intrinsic value, and used by green appraisers! greencommunities.com is the first green portal to connect and document all the related vertical industries, Starting with the green appraisers, greenbrokers, greencontractors, greenmortgages, greenira, greenpolicyholders and the emerging green securities using smart convergence direct navigation keyword technology.

Previously, all of the individual industries operated in “silos” separated industries, adding confusion to the publics/business perception of documented increased financial and productivity value for green building. Allowing the term green washing to be coined and used. greencommunities.com articulates how each green industry is integrated, dependent and aligned with all of the other vertical green industries, working cohesively which benefits the sustainable homeowner or sustainable corporation financially!

Brand Your Company Green!

To purchase, advertise, joint venture or inquire about Greenappraiser.com or any of our category defining domain names.